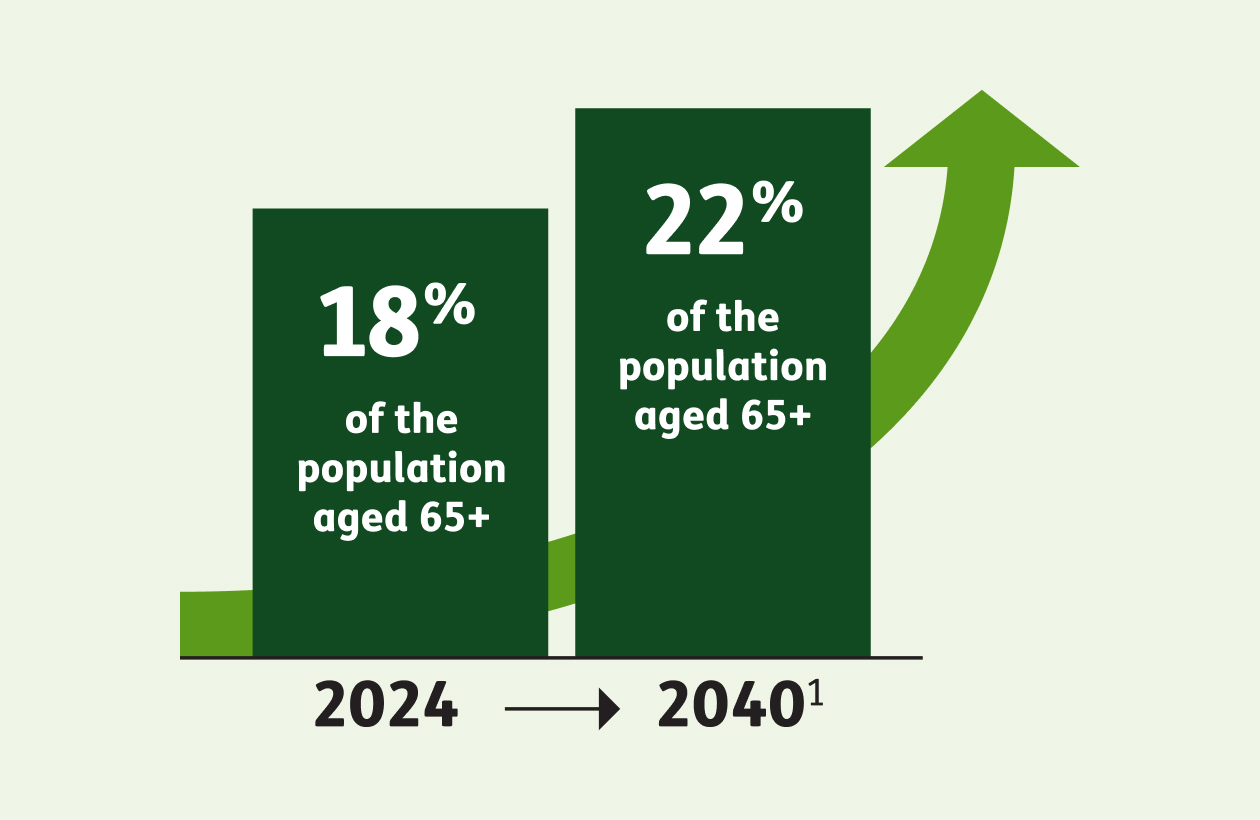

More than 4 million Americans turned 65 in 2024 and by 2040, adults aged 65+ are expected to comprise 22% of the American population, according to the National Council on Aging (NCOA)1. This is leading to an unprecedented surge in the Medicare-eligible population over a relatively short time frame.

A rapidly growing senior demographic presents a number of challenges, including:

-

Access to care issues:

The percentage of aging Americans in the population is growing more rapidly in rural areas. Given the shortage of healthcare specialists and primary care providers in rural regions, the local senior populations face greater challenges. For example, there is a relative lack of cancer screenings available in rural settings compared with more urban areas. Healthcare facilities in rural areas are also more likely to be understaffed compared with those in urban areas2.

-

Chronic disease burden:

More older adults may place additional strain on an already overburdened healthcare system, considering nearly 95% of older adults have at least one chronic condition, and nearly 80% have two or more, according to the National Council on Aging (NCOA)3. For employers, chronic conditions represent a top benefit cost4 and are a driver for the increase in premiums over the years. According to a report by the Employee Benefit Research Institute,5 20% of Americans with employer-based health benefits account for 80% of employers’ total spending on healthcare services—those living with chronic conditions account for a majority of high-cost claims.

21%of older adults

do not take their medication as prescribed at some point during the year due to the cost.8 -

Greater demand for prescription drugs:

Nearly 9 in 10 (89%) Americans aged 65+ take at least one prescription medication regularly6. Older adults are also more likely to take two or more prescription drugs. While this group is more reliant than other age groups on medication, a majority (76%) feels the cost of prescription drugs is unreasonable, and about a quarter say it is difficult to afford their prescriptions7. This can have serious negative consequences: 21% of older adults do not take their medication as prescribed at some point during the year due to the cost8. According to one study, cost-related nonadherence is associated with 15% to 22% higher all-cause mortality rates for all conditions, including diabetes, cardiovascular disease and hypertension9.

The design, structure and benefits of Medicare Advantage plans provide a solution to help address the unique challenges older adults face. Here’s how:

-

Focus on preventive care

According to a Willis Towers Watson survey, employers say they are prioritizing management of chronic conditions and investing in employee well-being to manage rising healthcare costs.10 More older adults with more chronic diseases means higher utilization of healthcare services, given the greater need for institutional care and other long-term services and supports. This underscores the importance of preventive care, both for promoting better health outcomes in older adults and as a means of containing costs for employers. Medicare Advantage has better preventive treatment for seniors and people with disabilities, according to an AHIP study11. The study compared performance results for Healthcare Effectiveness Data and Information measures focused on preventive and chronic disease care, looking at both Original Medicare and Medicare Advantage.

The data showed Medicare Advantage performed better than Original Medicare on 10 out of 11 preventive care measures, including cancer screenings, blood sugar level tests for diabetes patients and statin therapy for cardiovascular disease patients, among other areas of preventive care.11

10 out of 11

-

Better access to remote healthcare services

Remote healthcare services such as telehealth, remote patient monitoring programs and other virtual care solutions are a fast-growing supplemental benefit area within Medicare Advantage plans.

Telehealth benefits—offered by 98% of Medicare Advantage plans12—keep members out of the hospital by helping them manage their health at home, in turn containing care costs while helping improve members’ health outcomes. Telehealth benefits are also hugely beneficial to retirees living in rural or remote areas, providing access to a broad range of healthcare services for seniors who lack transportation options or are otherwise homebound.

Thanks to legislative changes implemented in 2020, Medicare Advantage plans can offer a wide range of telehealth benefits as part of their basic benefit package, going beyond what’s covered by traditional Medicare.

-

Cost advantage of MAPD plans

Most Medicare Advantage plans (89% in 202413) cover Part D prescription drug benefits, which helps protect retirees from the rising cost of medications and rising premiums for Part D standalone plans (which supplement traditional Medicare). This is because Medicare Advantage prescription drug (MAPD) plans can use a portion of their Medicare Advantage capitated payments to offer lower premiums or reduced cost-sharing. The capitated payments can also be used to offer coverage of more drugs.

The average monthly stand-alone prescription drug plan’s premium is $43, nearly five times higher than the $9 average monthly premium for drug coverage in MAPDs.14 Furthermore, two-thirds of all Medicare Advantage plans with Part D prescription drug coverage (67%) will charge no premium (other than the Part B premium) in 2025, similar to 2024 (66%).15

By integrating prescription drug coverage with other benefits—so everything falls under one cohesive plan—MAPD plans also enable care coordination and management of costs across a plan’s medical and drug benefits. This represents a huge advantage over stand-alone prescription drug plans.

Given how Medicare Advantage plans target the unique needs of older adults, perhaps it isn’t surprising that an overwhelming majority (95%) of Medicare Advantage beneficiaries report being satisfied with the quality of their healthcare16.

This may also explain why, beyond the spike in overall enrollment in Medicare Advantage, there’s also been a steady increase in Group Medicare Advantage enrollment, with the number of Group MA enrollees increasing from 1.8 million in 2010 to 5.7 million in 202417.

The verdict is clear: Group Medicare Advantage is a win-win for older adults, plan sponsors and the healthcare system as a whole.

- “Get the facts on older Americans,” National Council on Aging, last accessed Aug. 20, 2024, https://www.ncoa.org/article/get-the-facts-on-older-americans

- “Aging in Rural Communities,” National Library of Medicine, last accessed Aug. 20, 2024, https://pmc.ncbi.nlm.nih.gov/articles/PMC9644394/

- “Get the facts on chronic disease self-management,” National Council on Aging, last accessed Aug. 20, 2024, https://www.ncoa.org/article/get-the-facts-on-chronic-disease-self-management

- “Employers Focus on Clinical Conditions to Manage Health Benefit Costs,” PLANSPONSOR, last accessed Aug. 20, 2024, https://www.plansponsor.com/employers-focus-clinical-conditions-manage-health-benefit-costs/

- “Chronic Care Management Keeps Health Spending Under Control,” Society for Human Resource Management, last accessed Aug. 20, 2024, https://www.shrm.org/topics-tools/news/benefits-compensation/chronic-care-management-keeps-health-spending-control

- “QuickStats: Percentage of Adults Aged ≥18 Years who took Prescription Medication During the Past 12 Months, by Sex and Age Group,” National Health Interview Survey, last accessed Aug. 20, 2024, https://www.cdc.gov/mmwr/volumes/72/wr/mm7216a7.htm

- “Data Note: Prescription Drugs and Older Adults,” KFF, last accessed Aug. 20, 2024, https://www.kff.org/affordable-care-act/issue-brief/data-note-prescription-drugs-and-older-adults/

- Ibid.

- “Cost-related Nonadherence and Mortality in Patients With Chronic Disease: A Multiyear Investigation, National Health Interview Survey, 2000-2014,” CDC, last accessed Sept. 12, 2024, https://www.cdc.gov/pcd/issues/2020/20_0244.htm

- “Employers Focus on Clinical Conditions to Manage Health Benefit Costs,” PLANSPONSOR, last accessed Aug. 20, 2024, https://www.plansponsor.com/employers-focus-clinical-conditions-manage-health-benefit-costs/

- “New Study Demonstrates Higher Quality of Care in Medicare Advantage when Compared to Original Medicare,” AHIP, last accessed Aug. 20, 2024, https://www.ahip.org/news/press-releases/new-study-demonstrates-higher-quality-of-care-in-medicare-advantage-when-compared-to-original-medicare

- “Medicare Advantage 2021 Spotlight: First Look,” KFF, last accessed Aug. 20, 2024, https://www.kff.org/medicare/issue-brief/medicare-advantage-2021-spotlight-first-look/

- “Medicare Advantage 2024 Spotlight: First Look,” KFF, last accessed Aug. 20, 2024, https://www.kff.org/medicare/issue-brief/medicare-advantage-2024-spotlight-first-look/

- “Key Facts about Medicare Part D Enrollment, Premiums, and Cost Sharing in 2024,” KFF, last accessed May 16, 2025, https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-premiums-and-cost-sharing-in-2024/#:~:text=The%20%2443%20weighted%20average%20PDP,plan%20choices%20by%20new%20enrollees

- “Medicare Advantage 2025 Spotlight: A First Look at Plan Premiums and Benefits,” KFF, last accessed May 16, 2025, https://www.kff.org/medicare/issue-brief/medicare-advantage-2025-spotlight-a-first-look-at-plan-premiums-and-benefits/

- “Medicare Advantage Explained,” Better Medicare Alliance, last accessed Aug. 20, 2024, https://bettermedicarealliance.org/medicare-advantage-explained/

- “Medicare Advantage in 2024: Enrollment Update and Key Trends,” KFF, last accessed Aug. 20, 2024, https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2024-enrollment-update-and-key-trends/

Humana is a Medicare Advantage [HMO, PPO, and PFFS] organization with a Medicare contract. Enrollment in any Humana plan depends on contract renewal.

Limitations on telehealth services, also referred to as virtual visits or telemedicine, vary by state. These services are not a substitute for emergency care and are not intended to replace your primary care provider or other providers in your network. Any descriptions of when to use telehealth services are for informational purposes only and should not be construed as medical advice. Please refer to your evidence of coverage for additional details on what your plan may cover or other rules that may apply.

All product names, logos, brands and trademarks are property of their respective owners, and any use does not imply endorsement.