From the Postal Strike in 1970, where 210,000

postal workers demanded better wages, to folk hero Cesar Chavez’s struggle for the rights of

farm workers, unions have always been a driving force for change in the lives of Americans.

Healthcare is no exception: Since World War II, unions have fought to make primary care more

easily accessible and cost-effective for members.

Fast forward to today, one of every 10 workers in the U.S. belongs to a union, many of whom

are directly responsible for negotiating wages and healthcare benefits and administering

these benefits on behalf of members.1 In fact, because of these collective

bargaining

skills, unionized workers are more likely to have access to high-quality health benefits,

tend to pay lower premiums, and cover a lower share of out-of-pocket expenditures than

non-union workers.2

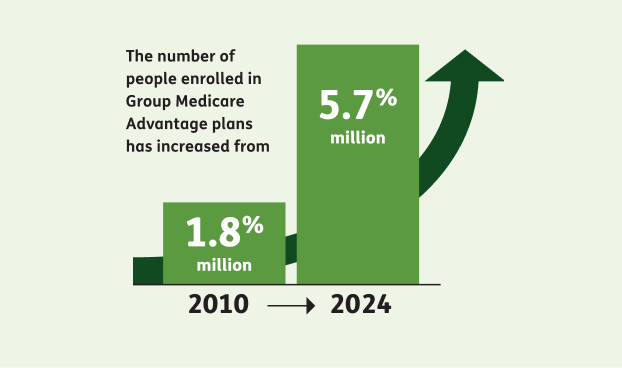

That’s great news for retirees, especially those enrolled in Group Medicare Advantage plans.

“Union members work incredibly hard to secure and maintain benefits provided by their union

while they are working and long into retirement,” says Nate Whiteman, a national labor

relations representative for Humana and a union member of the International Union of

Painters and Allied Trades (IUPAT) District Council 6 since 2002.

Here’s how unions are shaping healthcare benefit plans for retirees and their

growing

influence on everything from plan features to cost containment.